- By Admin

- 22 Jan, 2025

- Smart Invoice POS

What Is Small Business Accounting Software and Why Do You Need It?

In today’s fast-paced digital era, relying solely on manual bookkeeping is no longer sufficient for small businesses striving to stay competitive. Accounting software has become an essential tool, enabling small business owners to manage their finances with efficiency and accuracy while ensuring compliance with regulations. By automating routine tasks, accounting software frees up valuable time, allowing business owners to focus on growth and strategic planning.

Managing finances as a small business owner can often feel overwhelming. It’s not just about recording day-to-day transactions like income and expenses—it also involves adhering to tax laws and regulations, such as those outlined by the Zambian Revenue Authority (ZRA). Proper financial management and compliance are critical for sustaining and growing your business.

Selecting the right accounting software is key to unlocking these benefits. The ideal solution should align with your business’s unique needs, industry-specific requirements, and long-term scalability goals. It should offer a user-friendly interface, robust security features, and seamless integration with other business tools to streamline your operations.

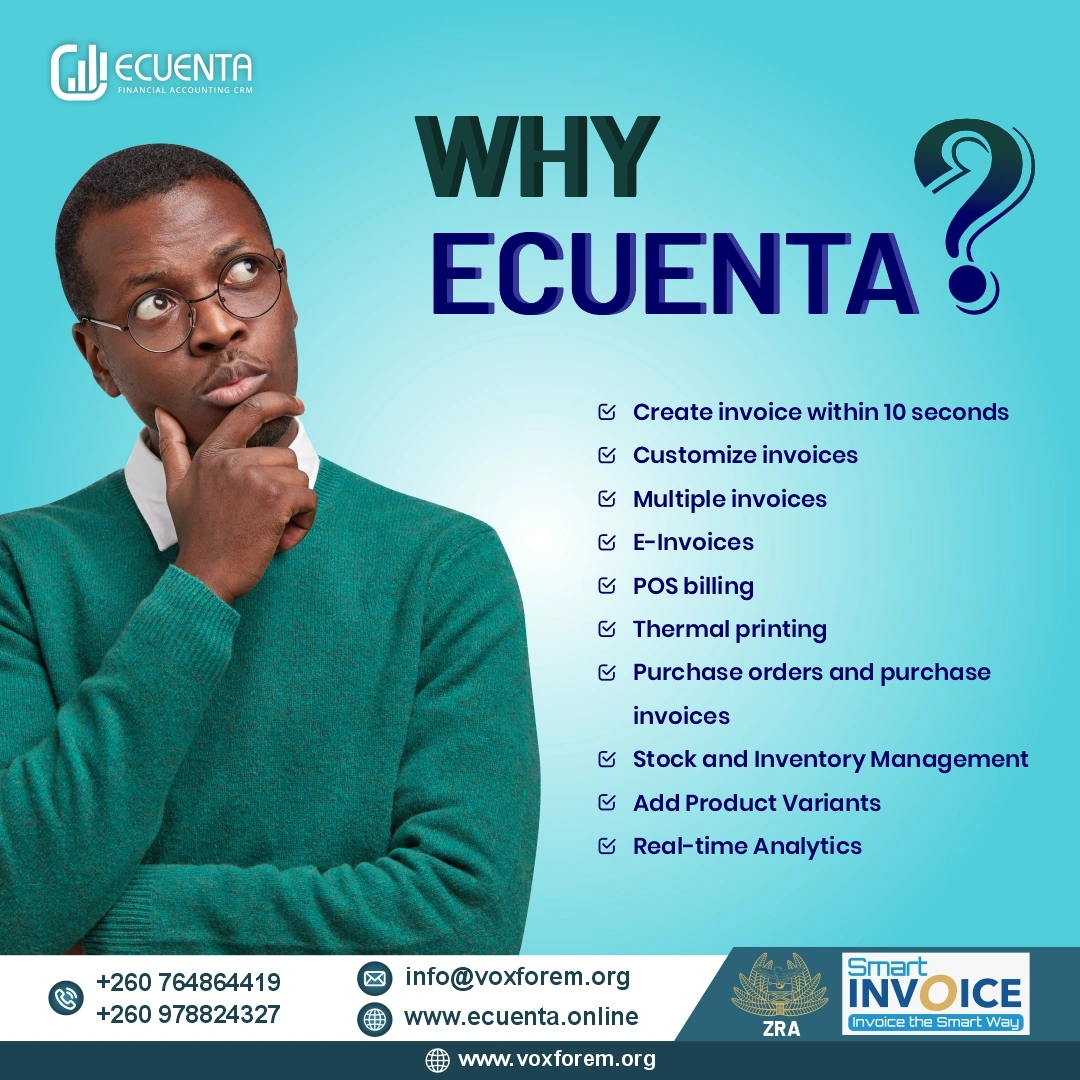

Choosing the right accounting software ensures your business stays organized and operates efficiently. For instance, software like Ecuenta Lite is designed to make financial management effortless for small businesses. It offers essential features such as smart invoicing, expense tracking, and budgeting tools, helping you manage your finances effectively and stay ahead in a competitive market.

What is Small Business Accounting Software?

Small business accounting software is a tool designed to help business owners, accountants, and bookkeepers streamline financial transactions, manage accounts, track cash flow, and assess the financial health of their company. By centralizing financial data in a digital platform, this software simplifies financial management, enhances accuracy, and offers valuable insights into a business’s performance.

Accounting workflows refer to the procedures involved in managing a company’s finances. These may include recording expenses in Accounts Payable immediately after they are incurred or at the end of the day. Optimizing these workflows saves time, reduces costs, and ensures consistency, making it easier for other team members to step in and manage financial tasks when needed.

Do I Need Accounting Software for My Small Business?

- Too Much Time Spent on Manual Tasks

- ZRA Tax Compliance Made Easier

- Budgeting and Forecasting

- Expense Tracking

- Time-Saving Automation

- Simplified Payroll Management

- Financial Clarity and Control

- Performance Evaluation

Too Much Time Spent on Manual Tasks

Manual bookkeeping can be time-consuming and repetitive, particularly with double-entry systems where tasks are often duplicated. Accounting software manages these processes, saving valuable time that can be redirected toward strategic business initiatives and growth.

ZRA Tax Compliance Made Easier

Accounting software is designed to align seamlessly with your company’s ZRA tax regulations, simplifying tax-related tasks. Whether dealing with multiple tax rates or complex calculations, the software handles the process, reducing errors and ensuring accuracy. It also provides stakeholders with clear financial insights while organizing reports efficiently to keep your business on track.

Budgeting and Forecasting

For small businesses operating with limited resources, financial planning is essential. Accounting software facilitates budgeting by helping set financial goals and allocate resources effectively. Forecasting tools enable businesses to predict future trends, identify potential risks, and prepare for contingencies, ensuring financial sustainability and stability.

Expense Tracking

Accounting software makes tracking expenses effortless. By categorizing expenditures, it provides a clear overview of your spending patterns. Additionally, many platforms allow you to upload and scan receipts, automatically extracting and storing key information, making cash flow management more efficient.

Time-Saving Automation

Designed to streamline operations, accounting software eliminates the need for tedious manual processes. From reducing paperwork to routine bookkeeping tasks, it significantly cuts down the time spent on financial management. Once set up, it can save you hours each week, allowing you to focus on growing your business.

Simplified Payroll Management

Many small businesses rely on accounting software to handle payroll processes. With built-in payroll functionalities, the software simplifies employee payments, calculates contributions for healthcare and insurance, and ensures precise payee tax compliance. This makes payroll management efficient and stress-free.

Financial Clarity and Control

Accounting software offers a clear and detailed view of your financial health. Maintaining accurate records of income, expenses, and assets, helps track performance, identify areas for cost reduction, and ensure resources are allocated efficiently. This financial clarity supports better decision-making and effective resource management.

Performance Evaluation

One of the key advantages of accounting software is its ability to measure business performance through financial metrics such as profitability, liquidity, and solvency. These indicators provide valuable insights into the company’s financial stability, helping business owners, investors, and creditors assess its potential for growth and success.

Why Your Business Needs Accounting Software

Transitioning from manual financial processes to easy accounting software can significantly enhance the efficiency and accuracy of your business operations. For small business owners, accounting software is an essential tool that offers the following benefits:

Accurate Financial Reporting:

Generate precise financial reports effortlessly, ensuring better decision-making.

Error-Free Data Entry:

Maintain accurate records with streamlined data entry processes.

Bank Account Integration:

Link your accounts directly for seamless payments and deposits.

Payment Reminders:

Schedule reminders for vendor payments and invoices, reducing the risk of missed deadlines.

Customizable Reports and Graphs:

Create visually appealing, tailored reports for a professional presentation.

Payroll Management:

Simplify payroll calculations, including taxes and employee wages.

Efficient Transaction Recording:

Promptly key in transactional data to maintain up-to-date financial books.

Inventory Tracking:

Gain clear insights into inventory levels to manage stock efficiently.

Summary:

Accounting software has evolved from being a luxury to an essential tool for businesses of all sizes. It streamlines financial management, improves accuracy, and saves valuable time by handling tasks like invoicing, real-time reporting, and ensuring compliance with regulations.

For small businesses, the benefits are particularly significant. Accounting software simplifies smart invoicing, expense tracking, and report generation. It helps you organize your finances more effectively while potentially reducing costs over time. When selecting accounting software, it’s crucial to assess your business’s unique needs, the software’s scalability, and its overall affordability. Additionally, remember that accounting software works best when complemented by the expertise of a human accountant.

Leap today to enhance your business’s financial operations, boost efficiency, and maintain a competitive edge in the marketplace.